Open Banking & Instant Payments from Nuapay on Vimeo.

Fast. Secure.

Cost Effective.

Accept Open Banking payments from your customers today, and harness the

revolution in open banking.

Open Banking is the fast, secure, and cost effective alternative way for merchants to accept payments. Through Nuapay’s unique, FCA regulated solution, customers pay by bank transfer, sending funds directly from their bank account to the merchant’s, where the money arrives instantly.

Its as simple as that. No cards. No chargebacks. No fuss.

Fast

Fast, easy customer checkout

Merchant receives funds in real-time

Send refunds back to customers in real-time

Set up instalment plans or recurring payments

Real-time webhooks to confirm funds received

Secure

Fully SCA compliant payment method

Consumers connect securely to their internet / mobile banking to make a payment

Fraud free by design

No credentials or account details disclosed to merchant

No PCI DSS requirements

Cost Effective

One, simple, low-cost fee

No charges on failed or declined transactions

No chargebacks, minimising back office headaches

Full reconciliation files to support easy servicing

Simple API integration

Find out how Nuapay’s solution is unique, with all the features you’d expect of a modern payment method, including refunds, instalment options, and real-time API and webhook integrations

Contact the teamHow does Open Banking work?

Open Banking is a new way to pay, enabled by the European PSD2 regulations. Using Open Banking, customers initiate a payment to a merchant or corporate using their mobile banking App or online banking webportal, in exactly the same way that they initiate a bank transfer. Funds are then transferred to the merchant immediately using the real-time banking rails.

OpenBankingOverview from Nuapay on Vimeo.

Why use Nuapay?

Nuapay is a pioneer and industry leader in Open Banking and Account-2-Account payments. Our API based Open Banking payment method, provides a complete payment solution that addresses all of your needs, whether you be a PSP, merchant, or a payer. Our solution provides:

A fully licensed solution

Nuapay is licenced by the FCA as an Authorised Payment Institution with permission to operate as a Payment Initiation Service Provider (PISP), enabling us to power the full set of payment options and functionality

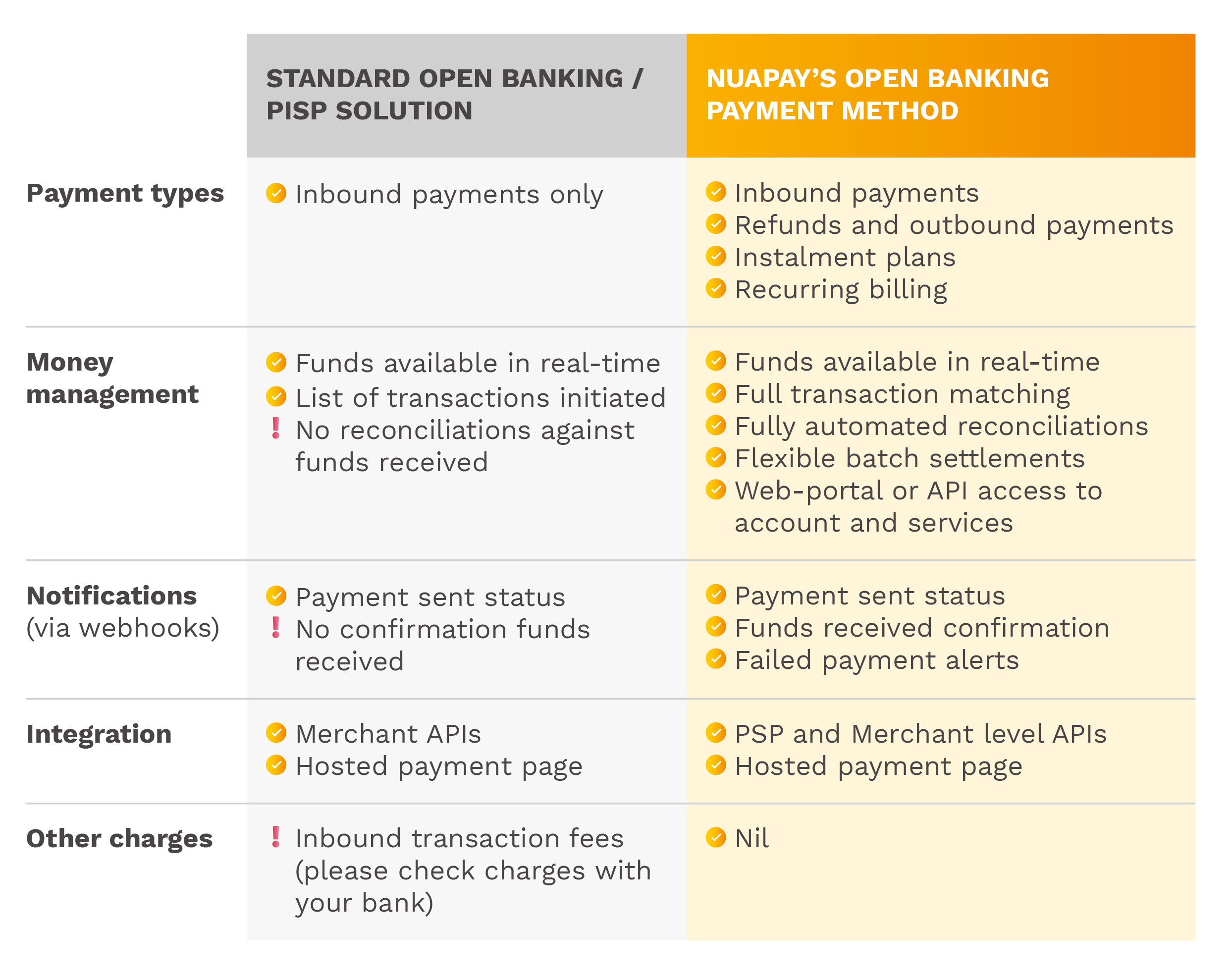

How does Nuapay compare?

Additional Resources

Open Banking World Series Report

See the benefits of Open Banking solutions and why merchants are starting to adopt these payment methods

Integration

guides:

API docs

See how easy it is to connect to our APIs to start accepting payments direct from your customers’ bank accounts today